Fidelity Bank Plc (“Fidelity Bank” or the “Bank”) has concluded all necessary arrangements to raise a total of up to ₦127,100,000,000.00 (One Hundred Twenty-Seven Billion, One Hundred Million Naira) by way of a Rights Issue to existing shareholders and a Public Offer (the “Combined Offer”). The Combined Offer is a part of the Bank’s strategy to increase its share capital base in compliance with the revised minimum capital requirements for Nigerian commercial banks introduced by the Central Bank of Nigeria (“CBN”) on 28 March 2024. Overall, the Bank expects that the capital raised would support the Bank’s efforts to drive sustained growth and diversification of its earnings base.

The Signing Ceremony with respect to the Combined Offer was held at the Board Room of the headquarters of Fidelity Bank in Lagos on Wednesday, 5 June 2024. The Bank’s shareholders had already approved the Rights Issue and Public Offer at the Extra-Ordinary General Meeting held on Friday, 11 August 2023. Under the Rights Issue, 3,200,000,000 (Three Billion Two Hundred Million) ordinary shares of 50 kobo each will be offered in the ratio of 1 new ordinary share for every 10 ordinary shares held as of 05 January 2024, at ₦9.25 per share. For the Public Offer, 10,000,000,000 ordinary shares of 50 kobo each will be offered to the general investing public at ₦9.75 per share.

Stanbic IBTC Capital is the Lead Issuing House to the Combined Offer, whilst the Joint Issuing Houses include Iron Global Markets Limited, Cowry Asset Management Limited, Afrinvest Capital Limited, FSL Securities Limited, Futureview Financial Services Limited, Iroko Capital Market Advisory Limited, Kairos Capital Limited and Planet Capital Limited. The Acceptance and Application lists for the Rights Issue and Public Offer are expected to open on Thursday, 20 June 2024 and close on Monday, 29 July 2024.

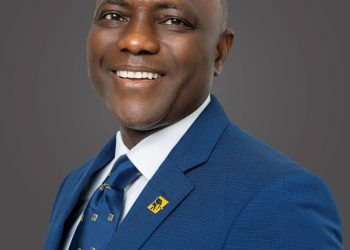

At the Signing Ceremony, Managing Director and Chief Executive Officer, Fidelity Bank PLC, Dr. Nneka Onyeali-Ikpe, disclosed that the proceeds of the Combined Offer will be applied towards investment in IT infrastructure, business and regional expansion

, and investment in product distribution channels.

The Chief Executive of Stanbic IBTC Capital, Oladele Sotubo, commended Fidelity Bank’s management team for their commitment towards executing the Combined Offer. He lauded their efforts for being at the forefront of achieving the CBN’s revised minimum capital requirements for Nigerian commercial banks. While thanking the Bank for trusting Stanbic IBTC Capital to lead and advise on this landmark transaction, Dele expressed confidence that the deal would encourage other corporates to tap into the equity capital markets to raise funding to meet their strategic business needs.

The rights circular for the issue, which contains a Provisional Allotment Letter and the Participation Form, will be mailed directly to shareholders of the Bank. Printed copies of the Public Offer Prospectus can be obtained at the offices of Fidelity Bank and the Issuing Houses during the Public Offer Application Period.

All existing shareholders and prospective investors are encouraged to read the Rights Circular and Prospectus and, where in doubt, consult your Stockbroker, Fund/Portfolio Manager, Accountant, Banker, Solicitor, or any other professional adviser for guidance before subscribing.