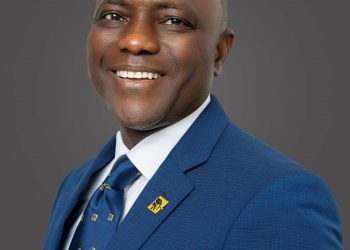

Managing Director/Chief Executive Officer of FirstBank, Dr. Adesola Adeduntan, has advised financial institutions in the country to be vigilant and improve the monitoring of their customers’ loans in order to prevent the build-up of non-performing loans (NPLs) in the industry as a result of the macroeconomic challenges.

Speaking in an exclusive interview with THISDAY, Adeduntan also urged businesses and their bankers to approach the new year in a collaborative relationship in order to overcome anticipated headwinds in the economy.

Adeduntan explained, “To prevent rising NPLs, businesses and their bankers will have to collaborate more and ensure timely flow of information to prevent surprises.

“Banks on their part will have to improve monitoring of their loan portfolio to quickly identify early warning signals for attention before a full-scale loan deterioration.

“Overall, businesses and their bankers must approach 2023 with a partnership mindset to ensure that a win-win outcome is achieved despite the anticipated macroeconomic challenges.”

Managing Director of the International Monetary Fund (IMF), Kristalina Georgieva, recently warned that 2023 would be tougher than 2022 for much of the global economy, as the United States, European Union and China see slowing growth.

Georgieva had said 2023 would be a “tough year”, with one-third of the world’s economies expected to be in recession.

The IMF had in October cut its global growth forecast to 2.7 per cent, down from 2.9 per cent forecast in July, amid headwinds, including the war in Ukraine and sharply rising interest rates.

Owing to the anticipated weakening of the global economy, Adeduntan said with slowing growth and elevated inflation rates, the sustainability of foreign debts, especially for developing nations, was likely to call for a re-evaluation by lenders given the increased likelihood of default.

He stated, “When this is juxtaposed with the higher interest rate environment at which these debts are likely to be refinanced, you will observe a scenario where further strain is exerted on the debt repayment capacity of these economies

“However, this situation does not necessarily translate to an automatic economic doom for developing nations. The actual impact on each developing economy will depend on the economy’s level of fiscal discipline and revenue generating capacity.

“Developing nations, who are able, in the short term, to increase revenues either from taxes or sale/refinancing of idle/sub-optimal assets will be able to negotiate reasonable refinancing terms from lenders and prevent further economic turmoil.

“Nonetheless, all concerned nations need to take the issue of debt sustainability more seriously by limiting fiscal wastages, reducing inefficiencies, growing revenues, and aggressively working down unsustainable debt-to-GDP levels that may worsen the impacts of external shocks.”

Adeduntan also pointed out that expectedly, rising cost of debt and contracting demand would exacerbate the challenges that businesses would face this year, particularly for players operating in small-margins sectors of the economy.

Locally, the surging inflation rate was also expected to reduce disposable income of most consumers and demand for non-essential goods and services may dip, he said.

He, however, pointed out that despite the expected macroeconomic challenges in 2023, there were also emerging business and revenue opportunities that could be exploited by discerning players in the financial services industry.

Specifically, he identified the areas that would provide significant opportunity to players in the financial services industry to include payments, digital security, mergers and acquisition (M&A) opportunities, partnership across segments and consumer lending.

Adeduntan explained, “The Central Bank of Nigeria’s renewed drive on cashless policy has provided an opportunity for players in the financial services industry to enhance existing digital product offerings and create more attractive product offerings that will further reduce frictions in the payment process.

“This will help to reduce the financial exclusion gap, increase fees and commissions revenues, and improve overall viability and stability of the financial system.”

In the area of digital security, the chief executive said, “Increasing adoption of digital payments platforms will necessitate increased requirement for the security of payment channels. Thus, opportunities exist for players in the financial services industry to leverage robotics and artificial intelligence to improve security protocols on digital payment channels.”

He added, “With the anticipated pressures on earnings, opportunities exist for big and liquid players to gain additional scale and market share through outright acquisition of fringe players with the right strategic fit.